I was going to post about something else today, but last night I heard about a friend of mine whose marriage has hit a huge speed bump. They have 2 very young kids and one of the things that’s on her mind is how she’d manage financially on her own.

I remember that feeling so well.

The scariest thing I ever did was to end my marriage with 4 boys under 5. When I was making the decision, I remember sitting on my back step, watching my little boys happily playing in the backyard. I remember hugging myself and whispering, “I can’t do it. It’s too hard. What if I muck them up?”

And then the thought occurred to me. It wasn’t the clincher – A. provided that for me a week or so later when he leaned against the door jamb and said, “In marriage, you always get another chance” and I realised I was pushing s**t uphill – but this back-step thought was hugely important in making me face my situation.

I was watching these beautiful, loving, innocent boys running around and I thought, “What if they grow up thinking that this unhappy marriage is normal and then THEY end up getting divorces because you were too gutless to break the cycle?”

All my worries about finances and the mortgage and ‘how-will-I-support-so-many-kids-on-my-own’ fell away when I confronted their emotional futures. It was 1997. If, in 1997, I was desperately unhappy with how I was being treated, then women in 2020 (say) would DEFINITELY not be happy. My boys would be wrecking relationships left, right and centre and they’d be miserable without knowing what they were doing to cause it. And it would all come down to me being a coward or not.

Up until then, I had told no one how I was feeling about the marriage. I hadn’t mentioned a word of the dynamic that was going on and the things that were happening. I told myself that it was because I didn’t want to worry anyone.

But really, deep down, I knew that if I breathed a word about it, then I’d be forced to act. Once people know what’s going on, it forces you to confront your choices. It was easier to be an ostrich and try and let things go. To focus on being a mother and to ignore that gnawing feeling in the pit of your stomach when you see the husband walking up the driveway – is it a ‘walking on eggshells’ type of day? Or is it not? To visit friends and smile and pretend that this man that I didn’t even respect anymore was truly my heart’s choice.

It was a week after the door jamb remark that I ended our marriage. I talked to A. first, then I rang my sister. We were talking about that phone call a couple of years ago and she said, “At first I thought you were just having a whinge, but then I realised that this was something serious.”

That phone call changed everything. Then, word spread around my family and friends. Finally, the cold hard light of publicity was shining into the dark little fog of that marriage.

It’s amazing how easy it is to rationalise things when you’re within a relationship. Especially when there are small children involved – the amount of white noise and mind-numbing activity when there are toddlers enables so much prioritising of ceaseless activity instead of thoughtful reflection. Things can drift along for years without people dealing with them. I know that’s what happened with us.

But once other people start to get an idea of what’s really going on, you can’t continue to ignore. Not if you want to have a shred of credibility again. Once the words are out, there’s no way to unsay them and it forces you to move forward.

And that’s a very good thing. This is what’s happening to my friend and I’m pretty sure she’s weighing things up very seriously right now.

I understand my friend’s concern about finances. Those children aren’t going to go out and get jobs and support themselves – they’re 3 and 1. Thinking about finances in this situation is the mark of a good, responsible parent. When you have those little lives depending on you, you have to make adult decisions.

I remember thinking about having to sell the house – where would we live? Who would rent to a single mother with 4 kids? Who would rent to this family AND 2 dogs? No one, that’s who. Given this, how could I buy A. out and keep the house? I had no money. How would I support them all adequately? I knew I couldn’t go back to work – the childcare fees for the boys would eat up my entire wage. I knew I’d get the Sole Parents’ payment, as it was called back then. But would it be enough? There were so many financial unknowns I was stepping into. It was truly frightening.

Our financial situation was parlous. We had a mortgage of a little under 100K and $120 in the bank. To say that I was worried about how we’d manage is an understatement. I remember, the morning after my talk with A, I went to the bank and closed down our joint savings account. I gave $60 to A and kept $60 for us.

That’s what the boys and I started our new life with.

And you know what? We made it work.

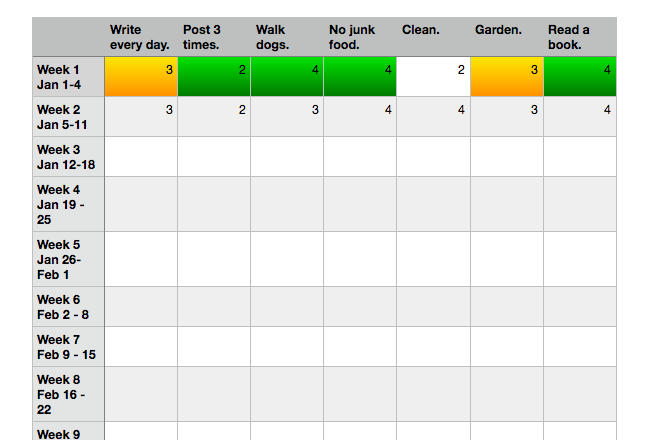

My first priority was to save 1K as soon as possible. I called it my ‘Buffer Zone’. I wanted that financial cushion between the big bad world and my children. I saved it in 3 months. Talk about extreme frugality! Our protein sources were tinned tuna, sausages and eggs, with the boys getting all the meat. (Well, sometimes I’d sneak the end of a sausage. I’m only human.) I filled them up on bread. We went to bed early to save electricity. I looked at every dollar 3 times before I spent it.

That first success in achieving that goal was hugely important for 2 reasons.

First, it showed me that I COULD DO THIS. I could cut my coat to fit my cloth and my boys were safer.

The second reason? This was a HUGE lesson in why having an emergency account is so very important. After I saved the 1K and mentally patted myself on the back, I decided to call the bank to check on the mortgage. A. and I had agreed that, in lieu of child support, he’d continue to pay it.

(People who’ve been through a divorce know what’s going to happen next… )

“I’m sorry, Ms Jones, but this account is in arrears.”

I wanted to throttle him. How dare he play with our kids’ security just to get back at me?

“How much is owed?” I asked. I spoke through visions of the bank reclaiming the house and selling it, the kids and dogs and I being forced onto the streets, apocalypse and flame and destruction raining down…

There was some clicking on a keyboard.

“963 dollars,” she said.

I paid it within the hour. I never trusted A. again with finances – which stood me in good stead in the future – and I learned the solid gold value of having some savings to fall back on. It’s a lesson that’s burned deep into my psyche. I gritted my teeth and built that ‘Buffer Zone’ back up again.

My advice to my friend, if she ever asks for it, would be to make decisions based on what’s best for the family’s future. Don’t let short-term fears derail reflection on what’s best for the long-term health and happiness of everyone concerned, particularly the kids. It’s funny how we parents won’t do things for ourselves, but once we view it through the lens of what’s best for our children, we’ll make the hard decisions.

I’d advise her to scrape together at least 1K as soon as possible. Keep it in an online bank that is a different one to the one she uses for her everyday banking, so she isn’t looking at that tempting pile of money slowly growing.

I’ve always been extremely debt-averse, so I didn’t have any debt owing on my credit card etc. If there’s debt in my friend’s situation, I’d be advising a scorched-earth policy – sell stuff, stop subscriptions, get rid of as much debt as possible asap. Be careful of joint accounts and joint loans – if he walks away from them, guess who is liable for the whole amount?

A week after I had The Talk with A, the bank rang. He’d applied for a 40K business loan and had put my name on it as well. The bank (thank God!) was calling to confirm that I was ok with that. When I said that no I was definitely NOT ok with that because we had recently separated, they denied him the loan. I knew he’d be angry. (For the record, he was.) But imagine if my name was on that? He’d walked away from the mortgage – he would’ve walked away from this too and I would’ve been on the hook for it. I never would have been able to carry that loan and be able to keep the house.

I would tell her not to be scared, even though this is the scariest decision she’ll make. She has a degree and a career path open to her in the future. I’d tell her that this is exactly what I had and it saved our financial bacon.

I’d tell her that being frugal is probably the biggest weapon she has at her disposal. Whether she stays or goes, her situation will always be better if she spends less than she makes.

I’d tell her to never let finances and the fears of “what if” lock her into an unhappy situation. She’s a smart woman. She knows the value of a dollar. She loves her kids and (probably) her husband. She’s more than capable of taking the time to look at the relationship clearly and with her priorities in place and to work out where to go from here.

Is this crunch time for this marriage? I have no idea. I know that it took me a long time to weigh up everything, battle my fears and then make my decision. You know, I think that because I took so long to clearly weigh up everything, this was a huge part of why, when I chose to take action and leave, I’ve never felt even a pang of regret. In my case, leaving was the correct thing to do.

I know that this is a very difficult time for my friend. The cold hard light of day is now shining in on her marriage. She’s not alone. Around 50% of marriages end in divorce.

My heart goes out to her. When I think of her, I go back to that scared young woman back in 1997, sitting on the back doorstep and hugging herself while watching her children play. Embarking on a new life as the sole provider for your children is taking a huge leap of faith. Whether she chooses to take that path is not my call to make.

But I know that whatever she decides to do, she has enough grit, brains and backbone to make it a success. Her children are very lucky to have her.

However, once Poppy and Jeff have some counselling and get their goals back into realignment, we all set off together.

However, once Poppy and Jeff have some counselling and get their goals back into realignment, we all set off together.